Steps to Take Before the Last Day of the Fiscal Year

Review your profit and loss statements

Your business’ profit and loss statements will help you get a snapshot of its financial performance. What does your revenue look like now that the year is almost through? Do you anticipate any other large expenses to hit your books? If not, evaluate how much money you have available, and see if it might be wise to make a larger purchase before the end of the year so that the item can depreciate.

Verify Your Vendor and Lender Files

It’s important to review the paperwork—including 1099s—associated with any of your vendors, as well as information relating to any current outstanding loans. Make sure all of your vendor 1099 forms are up-to-date and accurate. You also want to make sure the 1099 information has been inputted correctly into your accounting system so that it’ll populate the forms when printed.

Take Inventory

If you sell products, conduct an inventory assessment and compare the results to your last inventory report. Make any necessary adjustments so that you have an accurate account of how much capital you have wrapped up in your current inventory.

Look for Benefits to Report on Your Outgoing W-2

As a business that issues W-2s, these benefits relate to the organization as a whole and can reflect things such as health and life insurance, transportation subsidies, educational reimbursement programs and more.

Create a Budget for the Following Year

It’s never too early to plan. By reviewing your statements from the current year, you’ll start to see a pattern in the things you need to budget and plan for in the next year. By taking stock of your expenditures from the current year, you’ll have a better understanding of where to focus your efforts moving forward.

What is a Single-Member LLC?

A single-member limited liability company (SMLLC) is a limited liability company (LLC) which has one owner. A single-member LLC is a business entity registered in the state where the company does business. The term single-member is a recognition that the LLC has one owner, and that the owners of an LLC are termed "members."

How to Form a Single-Member LLC

To form a single-member LLC, you must go to your state's department of state (business division) to obtain information on the process, including filing Articles of Organization (or a Certificate of Organization in a few states) and paying a filing fee. After filing this state business registration, you should consider also preparing an operating agreement (similar to by-laws for a corporation), to spell out how you will run this business.

How a Single-Member LLC is Taxed

Single-member LLC's are subject to several different kinds of federal and state taxes as a business entity. These taxes are the same as paid by other types of businesses, but the method of payment is different for the SMLLC.

Small business owners often have a running list of things to do. These include deadlines, sales calls, employee issues, banking, advertising – and taxes. The IRS can help with the last one.

Here are seven resources to help small businesses owners with common topics:

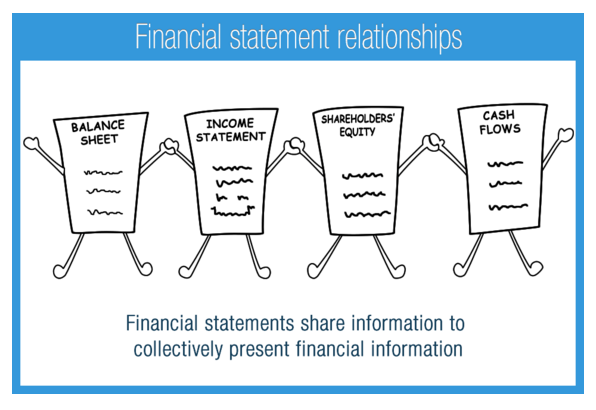

How does your business assess its financial strength? No doubt you refer to your income statement and your bank account for the basics, but the truth is most businesses ignore the most powerful financial tools in the accounting arsenal: the balance sheet and the cash flow statement.

The bottom line

While the cash flow statement is often considered the most important financial statement for a small business, the three main financial statements are interrelated. Viewing them holistically can help you make smart financial, investment, and management decisions for your business.

Of course, that’s easier said than done, so be open to getting help—whether from an accountant or from free resources such as the expert mentors at SCORE. Getting your arms around your financial data may be the most important thing you do this year.

Hiring a bookkeeper has significant benefits, including:

Minimizing and Catching Potentially Costly Errors

This is the biggie. From data entry mistakes to lost transactions to personal/ business expenses mix-ups, there are myriad ways books can go wrong. A bookkeeper’s expertise means, first of all, that he or she will make fewer errors in recordkeeping, and secondly, that he or she will spot problems.

Eliminating Late Fees by Paying Bills Promptly

It’s easy to get behind on paying bills and invoicing (more on that in a minute) when you’re juggling bookkeeping with running your business. A bookkeeper will help you get your bills in order—and make sure that they get paid on time. In “When to Hire a Bookkeeper or Accountant,” The Fresh Diet CEO Zalmi Duchman tells Entrepreneur’s Eileen P. Gunn that he estimates his company is “saving 500 to1,000 in late fees per quarter.” That’s a lot of dough.

Decreasing Your Accounts Receivable Turnover by Invoicing Effectively

Getting your books in pristine shape means you’ll be able to invoice more effectively and quickly. Whether your bookkeeper does invoicing manually or sets up an automated system for you, you’ll be cutting down on the length of your invoicing cycle—and getting paid faster.

Eliminating Your Own Time Spent Bookkeeping

Hiring someone to do your books (whether that’s full-time, part-time, or on a handful of occasions yearly) means you don’t have to. That means you get back the time you were spending on recordkeeping. Depending on how complex your finances and the number of transactions you typically do, this could amount to quite a bit of your own time invested back into your business.

Understanding Your Numbers

You should have a good sense of your P&L and other numbers (especially if you’re doing your own books!). But a bookkeeper can help to clarify anything that is confusing about your figures and identify the cause of irregularities.

New user agreement and intermediate service providers

The IRS will be rolling out a new e-Services user agreement in late October. All e-Services users will be required to accept the terms of the new agreement.

The new user agreement will also address intermediate service providers, which are private companies that offer software or services to e-Services users, such as helping users gain access to taxpayer transcripts. The new user agreement will require tax professionals to ensure that any intermediate service provider they use does not store usernames, passwords, or PINs. Practitioners will also be required to notify clients if they use an intermediate service provider to gain access to taxpayer information.

New authentication process

All e-Services users will be required to register using a new secure authentication system. This will involve a two-factor authentication process, in which users will enter their username and password, and the IRS will then send a security code in a text message to their cellphone or to the IRS2Go app

Users who cannot authenticate their identity through the new system will have to go through the IRS help desk. However, the IRS says that even if a user validates his or her identity through the help desk, the user will still have to obtain a security code via text message or the IRS2Go app every time he or she logs in to e-Services.

WASHINGTON – The Internal Revenue Service today announced special relief designed to support leave-based donation programs to aid victims of Hurricane and Tropical Storm Irma. This parallels relief granted to Hurricane and Tropical Storm Harvey victims.

Under these programs, employees may forgo their vacation, sick or personal leave in exchange for cash payments the employer makes, before Jan. 1, 2019, to charitable organizations providing relief...

Georgia — Victims of Hurricane Irma that took place beginning on Sept. 7, 2017 in the state of Georgia may qualify for tax relief from the Internal Revenue Service.

The President has declared that a major disaster exists in the state of Georgia. Accordingly, the IRS announced today that affected taxpayers in the entire state will receive tax relief.

Individuals who reside or have a business in any of the 159 counties in Georgia may qualify for tax relief.

As Hurricane Irma weakened into a tropical depression, the IRS said it is providing tax relief to people affected by the massive storm in parts of Florida, Puerto Rico, and the Virgin Islands (IR-2017-150). The relief applies to any area designated by the Federal Emergency Management Agency as qualifying. The IRS disaster relief page currently lists the islands of St. John and St. Thomas in the U.S. Virgin Islands; the municipalities of Culebra, Vieques, Canóvanas, and Loíza in Puerto Rico; and Broward, Charlotte, Clay, Collier, Duval, Flagler, Hillsborough, Lee, Manatee, Miami-Dade, Monroe, Palm Beach, Pinellas, Putnam, Sarasota, and St. Johns counties in Florida as eligible for relief. In a statement, IRS Commissioner John Koskinen said, “The IRS will continue to closely monitor the storm’s aftermath, and we anticipate providing additional relief for other affected areas in the near future.”

The relief includes an extension of time to file certain individual and business tax returns and make certain tax payments. It applies to, among other situations, individuals who have returns on valid extensions due Oct. 16, 2017, and businesses whose returns are on valid extensions and are due Sept. 15, 2017. Both have until Jan. 31, 2018, to file.

The IRS is also extending to Jan. 31, 2018, the deadline for individual taxpayers to make estimated tax payments due Sept. 15, 2017, and Jan. 16, 2018. It noted that taxpayers whose individual income tax returns were on extension are not eligible for relief from paying any 2016 income tax because those payments were due April 18, 2017.

The IRS noted that a variety of other tax deadlines qualify for relief, including the Oct. 31, 2017, deadline for quarterly payroll and excise tax returns. In addition, the IRS announced that it is waiving late-deposit penalties for federal payroll and excise tax deposits normally due during the first 15 days of the disaster relief period.

The IRS automatically provides filing and penalty relief to any taxpayer with an IRS address of record located in the disaster area. Thus, taxpayers need not contact the IRS to get this relief. Although taxpayers who live in the affected areas should automatically qualify for relief based on their address in IRS records, if they mistakenly get a penalty notice, they should call the number on the notice.

In addition, the IRS says it will work with any taxpayers who live outside the disaster area if their records necessary to meet a deadline occurring during the postponement period are located in an affected area. These taxpayers should contact the IRS at 866-562-5227.

The IRS also announced that victims of Hurricane Irma who have retirement assets in qualified employer plans can take hardship distributions or loans from their plans to alleviate hardships caused by the hurricane (Announcement 2017-13). The IRS is also permitting such plans to disregard procedural requirements for plan loans for these purposes between Sept. 4, 2017, and Jan. 31, 2018.

Finally, the IRS also is waiving the penalty for using or selling dyed diesel fuel for use on highways in Florida between Sept. 6, 2017, and Sept. 22, 2017 (IR-2017-149).

Many small business owners use a sole proprietorship which allows them to report all of their business income and expenses on a Schedule C attachment to their personal income tax return. If you run the business as an LLC and you are the sole owner, the IRS also allows you to use the Schedule C and submit it with your 1040 tax return.

In contrast, partnerships, sole proprietorships, and limited liability companies (LLCs) are not taxed on business profits; instead, the profits "pass through" the businesses to their owners, who report business income or losses on their personal tax returns. Form 1065 is filed with IRS and schedule K-1 reports with your individual tax return.

If the only member of the LLC is a corporation, the LLC income and expenses are reported on the corporation's return, usually Form 1120 or Form 1120S.

Why does it matter? Because good accounts are the basis of a good business. If you don’t have an accurate grasp of your financial situation, your plans will be based on little more than guesswork. Investors or lenders will also want to see well-organized finances before they commit to funding your business.

Bookkeeping is the recording of financial transactions, and is part of the process of accounting in business. Transactions include purchases, sales, receipts, and payments by an individual person or an organization/corporation.

Six main groups are intimately connected to the life of a business. Knowing who they are, what they expect and how you’re interacting with each of them is essential.

Half of small business owners report that accounting is their least favorite task. Assuming you’re not an accountant yourself, you probably understand why. And if you mess up your records or bookkeeping? You could easily be looking at lost money, missed opportunities, or even a knock on your door from the IRS. No, thank you.

Although you might find it tedious at first, managing your small business’s financials properly is key to your success as an entrepreneur. But nobody said you have to do it all on your own. Every small business could use a great suite of accounting tools to help them out. If you’re talking about the world’s best accounting tools, it’s simply impossible not to mention the one and only QuickBooks Online.

QuickBooks Online offers the classic suite of accounting tools for anyone and everyone: dashboards for your business’s financial data and records, financial reports that you can customize according to your own needs, an invoice generator, online payment receipts, payroll processing, and the ability to turn pictures of receipts into catalogued business expenses. Plus, QuickBooks Online syncs with your bank account and business credit cards so that your business’s financial data is always up to date. And if that weren’t useful enough, you can also share your QuickBooks Online with your accountant to simplify financials during tax time.

Bookkeeping refers mainly to the record-keeping aspects of accounting. Bookkeeping is essentially the accounting process (some would say the drudgery) of recording all the information regarding the transactions and financial activities of a business.

Here are few basics of the most common types of bookkeeping accounts for a small business that you should know:

Many business owners think of bookkeeping as an unwelcome chore. But if you understand and make effective use of the data your bookkeeper collects, bookkeeping can be your best buddy, helping you run your business more effectively.

You are a business owner 365 days of the year. For the new business owner, oftentimes the “normal” work hours are spent building the business and talking to prospective clients. The evenings are typically for the administrative work and all of the other things you could not fit into the day. Many start a business to have control over their work schedule, which can happen—eventually but for many, it means no vacations and possibly no salary as everything you earn is being put back into the business.

Know your numbers. Understand how much money you need to break even and how to determine profitability. Knowing your numbers will help you to understand the financial health of your business. So many business owners grossly underestimate how much they will need to start their business, how much it will take to support the business before the business is profitable, and even how much to charge for the product and/or service. If you need help creating financial statements and analyzing your current or future business, let us help you. We can take care of your numbers while you are talking care of your business.

Do not forget Your Legal Entity Affects Your Tax Burden.

Think that all small businesses endure the same tax burden? On the contrary, the legal entity you elect to form can have a tremendous effect on your tax liability throughout the years.

From sole proprietorships and LLCs, to S corporations and partnerships, there are various business types, each with its own benefits and limitations. For example, S corporations offer small business owners the advantage of paying taxes at the shareholder level, rather than being subject to higher corporate rates. However, a company of this kind must be limited to 100 shareholders and feature a single stock class. On the other hand, while C corporations can deduct a wider range of expenses and include hundreds of shareholders, these groups must contend with double taxation.

One of the most unfortunate reasons that small businesses struggle is from miscalculating expenses and taxes.

No matter how strong your products and services, accurate accounting can make or break your business. What to Record In most cases, what you will record is the transaction you made with the customer. These are the incoming payments:

As a small business owner, it's important to keep track of every dollar that goes in and out of your company, including not only what you see on a day-to-day basis but also your monthly expenses. Remember that many of those payments you made may be deductible based on your income or the type of business you own – even coffee with a potential partner or the health insurance you purchased for yourself.

Often if you are the one undertaking the accounting, your book-keeping may take the lowest priority on your to-do list. But if you are outsourcing it to an employee or accountant, it is important that you ensure that your books are maintained on a daily or weekly basis. By doing so, you will ensure that the accounting for your business doesn’t pile up and important data is not missed or forgotten about.